Part 4 of 5

(This post was originally appeared in my previous blog in 2016).

In Your Innovation Roadmap, Part 1, I introduced the innovation matrix (featured above) and covered Quadrant 1: gaining market share. In Part 2, I covered Quadrant 2: bringing your current offerings to new customers. In Part 3, I covered Quadrant 3: bringing new offerings to existing customers.

I’m going to split our Quadrant 4 (bringing new offerings to new markets) discussion into two parts. In this first post, I’ll cover Macro & Micro Context, which discusses when to look to Quadrant 4 innovation (instead of Quadrants 1-3), and why it’s so hard for established companies to pursue this route. In the next post, I’ll cover a process and case studies for pursuing Quadrant 4 strategy.

QUADRANT 4: NEW OFFERINGS IN NEW MARKETS

At some point, a company’s growth stagnates. The industry that the company plays in grows stale, and/or the company’s offerings reach a market share that simply is not likely to grow further. And, so the company must look to new areas for innovation and growth. Why is this? There can be a variety of reasons related to the niche market dynamics of an industry, which I won’t go into in this post given the range of industries that I’ve been covering in this series. But, usually, if you dig deep enough, you’ll find that the reason for stagnation stems from a macro and a micro trend:

- Macro. The stage in which we find ourselves in our current technological revolution, and

- Micro. The Law of Diffusion of Innovation related to the company’s current offering(s)

Macro: Technological Revolutions

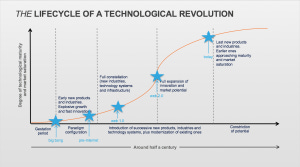

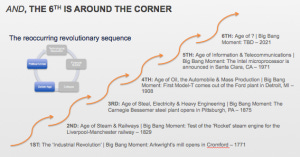

In The Purpose Economy: Part 3 – Technological Revolutions, I describe the lifecycle of a technological revolution, and how we are currently at the tail end of our current revolution. This is based on research from economist, Carlota Perez captured in her book, Technological Revolutions and Financial Capital.

As you can see from the image above, each revolution has a big bang moment where a discontinuous innovation comes to market, inspiring new products and industries, and driving fast innovation and growth. This period can be messy and chaotic, as society looks for economic models for this new technology. Later, come the systems and infrastructure that support the eventual full expansion of the new technology’s potential – an array of innovation with validated economic models. Finally, the last new products come to market, and the new technology that was introduced in the big bang moment reaches a mature market saturation point before the next big bang moment and new, discontinuous technology is introduced.

Today, we find ourselves at the end of our current revolution: the Age of Information and Telecommunications, whose big bang moment was the Intel microprocessor that was introduced in 1971. Over the course of approximately half a century, each revolution follows the same sequence: big bang moment –> financial bubble –> collapse –> golden age –> political unrest –> next big bang moment. Clearly, we had our big bubble and collapse with the Great Recession that hit in 2008. We’re now well into a golden age where microprocessors have achieved a global market saturation point, enabling the use of mobile devices worldwide, along with an array of software applications that our modern society now relies on, and, dare I say, takes for granted. And, given the current state of affairs across the globe, with frequent shootings and mass killings, divisiveness and political debate of the lowest common denominator, who can argue with the idea that we are experiencing political unrest? Finally, we are 45 years into our current revolution. The next big bang moment is right around the corner.

Understanding the technological revolution you’re operating in, at what stage of that revolution’s lifecycle your company finds itself, and what role your company’s offerings play in this landscape can give you some indication of the potential innovation opportunities available and growth runway left for your company’s offerings.

Micro: The Law of Diffusion of Innovation

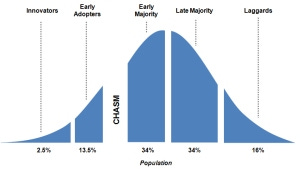

Popularized in Geoffrey Moore‘s book Crossing the Chasm, the Law of Diffusion of Innovation, described as the Technology Adoption Life Cycle, follows that

- 2.5% of our population are “innovators”,

- 13.5% are “early adopters”,

- 34% are the “early majority”,

- 34% are the “late majority”, and

- 16% are the “laggards”

Critical to launching a new offering in a new market, is identifying who are the innovators that actively pursue new offerings in that product segment. For a tech product, you might find these people on Product Hunt, Techmeme or lurking in subreddits. For a CPG company, these early adopters might be brand advocates for existing, related products that are already in market, or folks that are constantly testing out new products. They might be found writing volumes of reviews on Amazon or actively blogging, and can be as broad as the mommy blogger, or as niche as a foodie or beauty blogger.

Next to adopt a new product are the early adopters. Like the innovators, this consumer segment buys into new product concepts early, as they find it easy to conceive the potential of the product without that product being fully validated or perfect.

As Geoffrey Moore argued, the real difficulty for a technology (or any new product) to reach mass market appeal and achieve enough momentum to maximize its revenue and profitability potential is crossing the chasm from early adopters to early majority. Unlike the innovators and early adopters that preceded them, whose decisions are driven more by emotional and social factors, the early majority segment of consumer makes their decisions based on more rational factors and prefers to purchase products once they have been more fully validated by other consumers. But, once a company gains momentum with the early majority, it can expect a healthy business for some time to come. The early majority represents 1/3 of the adoption lifecycle, followed by the late majority, which also represents 1/3 of the adoption lifecycle. This late majority segment does not feel comfortable adopting a new product until it has become a standard. Finally, the laggards segment does not want anything to do with new products. They are very set in their ways, and do not adopt a product until they are forced to (which usually means that the product they like to use is no longer available).

Why Quadrant 4 is hard for established companies

Typically, established organizations struggle with Quadrant 4 because of the very fact that they gained traction with that early majority. As we learned from Steve Blank, a company is a permanent organization designed to execute a repeatable and scalable business model. On the other hand, a startup is a temporary organization designed to search for a repeatable and scalable business model. In other words, the business of a startup is to bring a new offering to a new market, test whether or not the market (i.e. the target customer) will adopt that new product, and validate a business model that will (eventually) generate profits. Whereas the business of a company is to scale that business model.

Once the company gains momentum with the early majority, focus shifts away from innovation and towards offering the company’s product more effectively and efficiently. In other words, infrastructure such as people, processes and technologies are brought into the company to enable the organization to meet consumer demand and offer more of its products at a reduced cost, increasing margin (profits). The initial focus is Quadrant 1: gaining market share. Later it shifts to Quadrants 2 and 3: offering current products to new markets, and offering new products to existing customers, respectively. Quadrants 2 and 3 only require incremental innovation and can leverage the company’s existing infrastructure. Quadrant 4, on the other hand, requires discontinuous innovation, and may need an entirely different infrastructure to succeed.

Understanding where your company’s offerings are on the adoption curve is critical to deciding on which quadrant to focus your innovation efforts.

Pursuing Quadrant 4 innovation

In the next post, I’ll cover a process for pursuing Quadrant 4 innovation and provide some examples of companies that have successfully done so.

To read about Quadrant 1 – grow market share – click here.

To read about Quadrant 2 – new markets – click here.

To read about Quadrant 3 – new offerings – click here.

(This post was originally appeared in my previous blog in 2016. I posted it here because the Innovation Roadmap Framework is timeless and still relevant today in 2024—though this post could be updated with some newer examples. If you have examples of companies that fit the Gain Share quadrant, and you’d like me to write about it, let me know in the comments.)